Ireland’s aquaculture sector demonstrated remarkable resilience and innovation last year despite facing challenges.

That’s according to the Annual Aquaculture Report from Bord Iascaigh Mhara (BIM). Based on the findings of the National Seafood Survey, the report examines the economic performance and social demographics of people employed in the sector in 2023. Several positive trends and developments in aquaculture highlight the sector’s potential and capacity for recovery and growth.

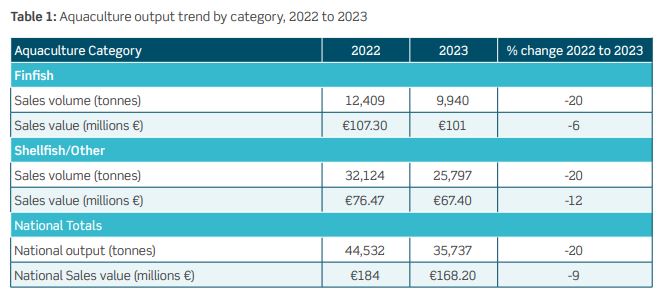

Decrease In National Aquaculture Output

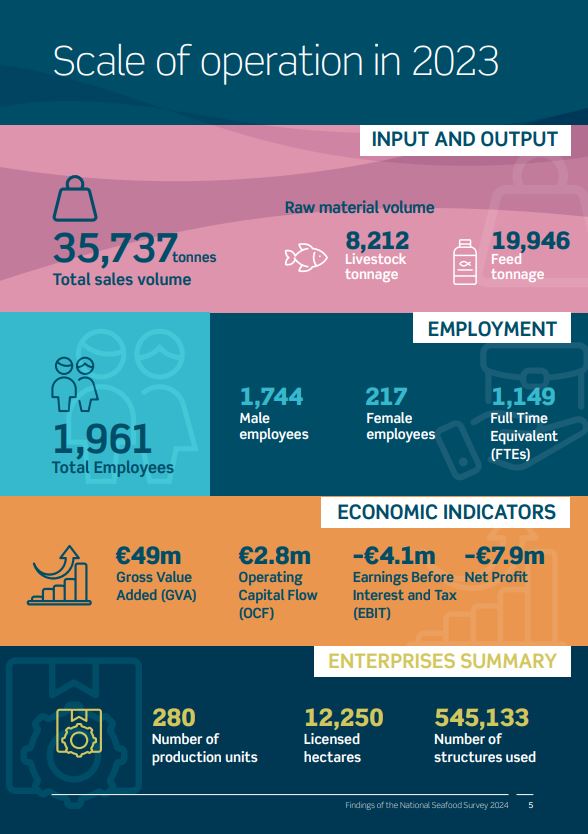

National aquaculture output fell in volume by 20% and in sales value by 9% in 2023. The smaller decrease in sales value indicates that unit sales value held or improved for some products. In 2023, the sector contributed €182 million to the economy, supporting 1,961 jobs with 1,149 Full-Time Equivalents (FTEs) employed across all production units. The average individual salary for the year was €36,500.

A total of 35,737 tonnes of aquaculture products were sold directly at the farmgate, generating sales of €168 million. Producers of premium-grade oysters achieved high unit prices, particularly in The Netherlands, reflecting the sector’s ability to compete in international markets with high-quality products. The demand for fresh rope-grown mussels recovered significantly in the second quarter, demonstrating the market’s resilience and the segment’s ability to recover from early setbacks.

Increases In Mussel & Seaweed Output

Employment in the suspended mussel culture segment increased, indicating ongoing investment in human resources and confidence in the segment’s future. Additionally, the seaweed aquaculture segment showed an 8% increase in output and an impressive 64% increase in sales value compared to 2022, signalling its maturation and progression to commercial-level production. These positive developments highlight the sector’s diversification and potential for future growth.

While national aquaculture output fell by 20% in volume and 9% in sales value, the smaller decrease in sales value suggests that unit sales values held steady or improved for some products. This demonstrates the market’s strength for higher quality or premium products.

The North region (Donegal) generated the largest regional revenue of €41 million, sustaining 623 jobs across 62 production units. This region supports key aquaculture segments, including farmed oysters, seabed cultured oysters, rope-grown mussels, and penned salmon. The Northeast, represented by Carlingford Lough, produced €7 million, employing almost 100 people, while the Southeast earned €19 million, employing 200 people in 29 production units.

Industry challenges

However, the sector also faced significant challenges. Salmon production at sea was affected by smolt supply shortages due to a lack of investment in hatchery capacity, rising sea temperatures, and biological challenges arising from these environmental challenges. The need to sell smaller fish to protect stock resulted in a shortage of larger fish later in the year.

Shellfish sales were hampered by market surpluses early in the year, particularly impacting standard-grade oysters in France. Additionally, deteriorating water quality affected shellfish meat yield and growth, leading to industry shutdowns in Waterford Harbour. Rising operational costs and labour shortages further strained all segments narrowing already stressed profit margins.

Overall

The ability to produce competitive, high-quality products, coupled with investments in human resources and diversification into new segments like seaweed, provides a solid foundation for future progress and sustainability. Overall, while the sector faced a challenging year, the positive trends and resilience demonstrated across various segments highlight its potential for recovery and long-term growth.