Industry challenges

A survey conducted on the sector’s technical challenges highlighted the struggle of shellfish segments in sourcing or retaining suitably trained staff. Consequently, these businesses are exploring technologies that have the potential to reduce or eliminate labour-intensive tasks in production. Water quality is a growing concern for all aquaculture businesses, and infrastructure upgrades to enhance product access and movement are pressing issues for many PUs. Additionally, businesses requiring the importation of non-native juvenile stock are increasingly concerned about seed survival.

Increase to Output Volume

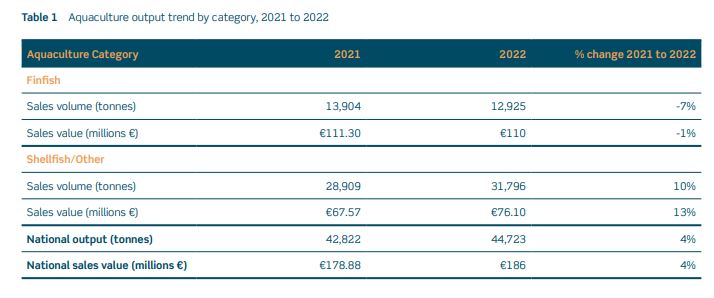

The report confirmed 2022 as a strong year for shellfish growers while seaweed and finfish producers both saw a drop off in output:

“A total of 44,723 tonnes of aquaculture products were produced, amounting to a sales value of €186 million. This represents a 4% increase in both volume and value compared to the previous year, where 42,822 tonnes were produced with a sales value of €179 million. The notable positive trend observed at the national level was primarily driven by the shellfish segments. These segments experienced a significant increase of 10% in output volume and a noteworthy 13% increase in sales value. The farmed oyster and rope mussel segments played a pivotal role in driving this trend, with the unit sales value per tonne of fresh product continuing to rise.

Conversely, the finfish segments faced a decline of 7% in output volume and a 1% decrease in generated sales value. However, the decrease in output volume was partially offset by increases in unit sales value across the finfish segments, providing some mitigation.”

Output & Production

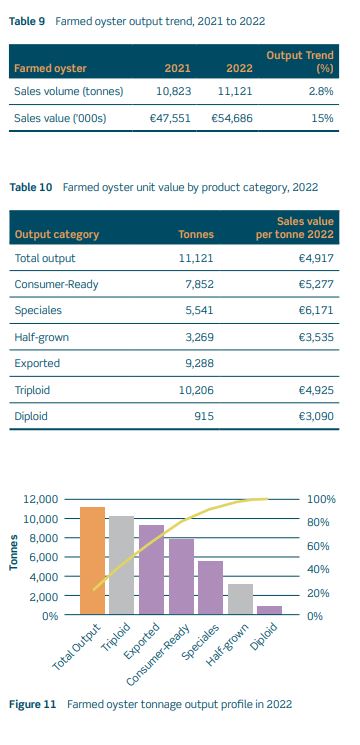

ting 52.6% of the national turnover in 2022.Specific bays such as Carlingford Lough, Bannow, Dungarvan, Castlemaine Harbour, Poulnasherry, Clew, Sligo Donegal, and Traigheanna Bays are increasingly producing specialised oysters, some meeting the “Speciale” standard, which is a recognised French standard.In 2022, the combined production units in the West and Northwest regions generated a sales value of €9.6 million. Overall, 11,121 tonnes of oyster products were harvested in 2022, a 2.8% increase from 2021, with a sales value of €54.7 million, indicating strong growth in unit sales values across various grades (Table 9). The unit sales value varied among different types of oysters, with diploid products experiencing a slight decline to €3.09 per kg, while consumer-ready triploid products sold for an average of €5.28 per kg.

ting 52.6% of the national turnover in 2022.Specific bays such as Carlingford Lough, Bannow, Dungarvan, Castlemaine Harbour, Poulnasherry, Clew, Sligo Donegal, and Traigheanna Bays are increasingly producing specialised oysters, some meeting the “Speciale” standard, which is a recognised French standard.In 2022, the combined production units in the West and Northwest regions generated a sales value of €9.6 million. Overall, 11,121 tonnes of oyster products were harvested in 2022, a 2.8% increase from 2021, with a sales value of €54.7 million, indicating strong growth in unit sales values across various grades (Table 9). The unit sales value varied among different types of oysters, with diploid products experiencing a slight decline to €3.09 per kg, while consumer-ready triploid products sold for an average of €5.28 per kg.

The top-grade “Speciales,” comprising 49.8% of the total sold volume, had an average unit sales value of €6.17 per kg, up from €5.54 per kg in 2021. Half-grown oysters destined for further growth also saw an increase in average unit value from €3.27 to €3.54 per kg (Table 10).

Total exports in 2022, including consumer-ready and half-grown oysters, increased slightly to 9,288 tonnes. Additionally, there is evidence of a growing domestic consumer market. Ireland retained 1,833 tonnes of farmgate output in 2022 representing an increase of 412 tonnes compared to the previous year.

Overall

Overall 2022 was a strong year for farmed oysters, a segment which experienced an increase in both sales volume and value. Investment in labour-saving measures and farming techniques which promote enhanced efficiency will be important in saving on costs into the future.